Real - Estate is the Purest form of Entrepreneurship – Brian Buffini

Dharamai offers fractional ownership for real estate investments.

Dharamai is a great place to invest in residential real estate, bank auction properties, and commercial real estate (CRE). Dharamai has made a name for itself in the overall real estate market as a dependable and knowledgeable participant because to its history of profitable real estate investments in a variety of asset classes.

- Residential and commercial real estate (rental income and property flipping)

- Properties Sold at Auction by Banks

- Metro city and developing city layouts

- Building (Residential & Commercial)

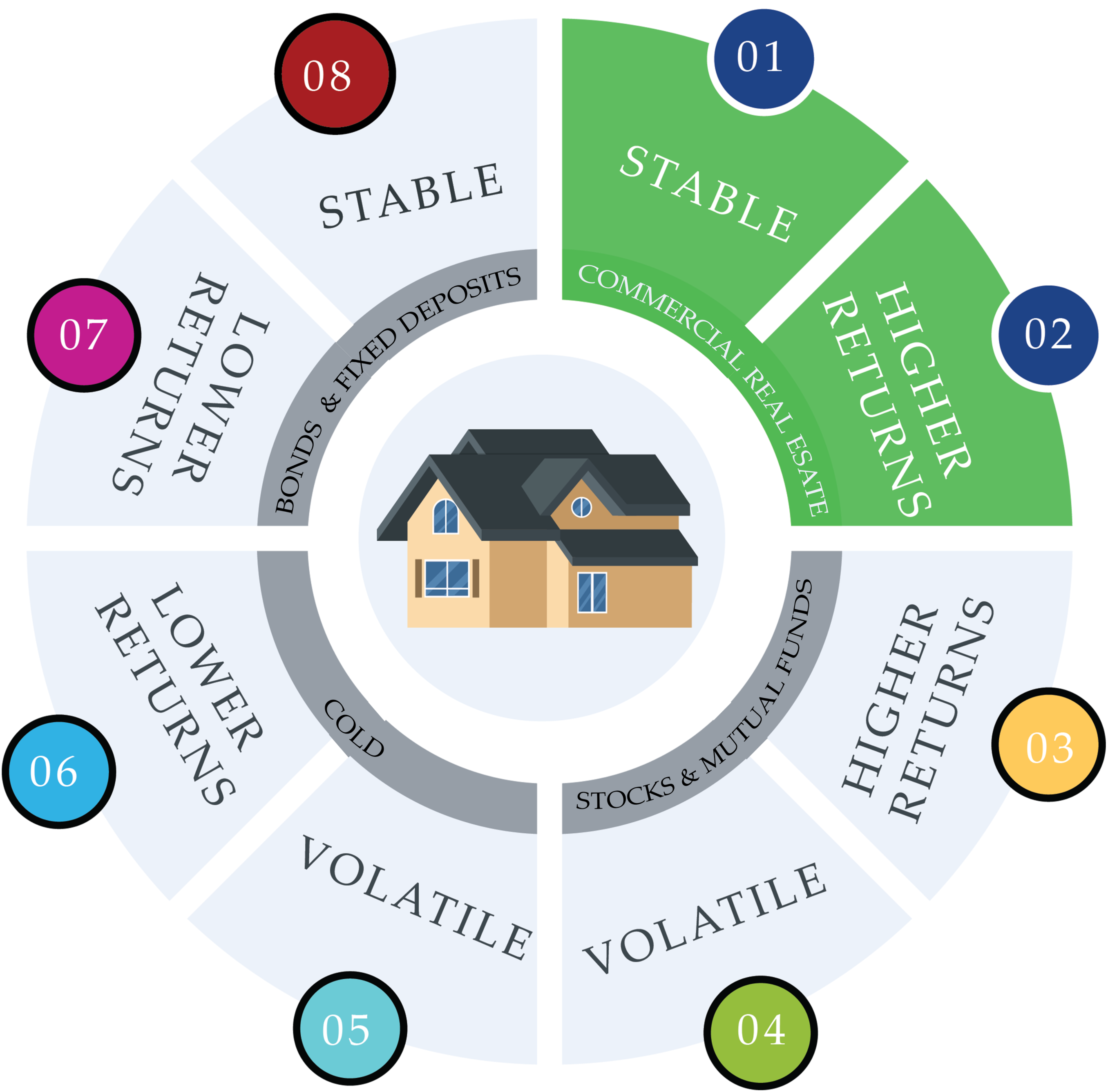

Why must you select asset-backed real estate?

Real estate fractional ownership is a fantastic method to make little investments and reap the greatest rewards from larger holdings.

According to numerous experts, a well-diversified portfolio should include real estate as one of its unique asset classes. This is due to real estate's generally weak correlation with commodities, stocks, and bonds. Beyond the possibility of capital gains, real estate investments can also generate income from mortgage payments or rent.